Randy W. Ferguson

UNINSURED AND UNDERINSURED MOTORIST ATTORNEYS

Ferguson & Ferguson

Attorneys at Law

Have you been injured by an uninsured, underinsured or hit and run driver? Are the bills piling up and you don’t know where to turn. We are here to help. Did you know that one in three Alabama drivers are driving without any automobile insurance coverage. Learning that you were hit by an uninsured motorist or underinsured driver can make a stressful experience even more worrisome. Many Alabama accident victims believe they are just out of luck if they are hit by an uninsured or underinsured driver. How will you pay your medical bills if the other driver is uninsured? What if a passenger in your car is seriously injured? Who is going to pay to fix the car? Don’t worry. Call a Alabama uninsured motorist accident attorney Randy W. Ferguson to discuss uninsured motorist coverage. Our Decatur and Huntsville uninsured motorist lawyers will explain how you can turn to your own auto insurance policy for coverage in these cases as well as in hit and run accidents. We have represented hundreds of Alabama motorists making uninsured motorist claims against their insurance companies. We do the hard work for you, demanding that your insurance company fully compensate you for all your damages as the liable motorist would if he or she was fully insured. As a result, your claim against your own insurance company may also include medical expenses, future medical treatment, and your pain and suffering. We offer no obligation, FREE CONSULTATIONS to all injury clients. We also have a LOWEST FEE GUARANTEE. Call 256-534-3435 or 256-350-7200. We are here to help.

What is Uninsured and Underinsured Motorist in Alabama?

Uninsured motorist coverage, also called “UM,” is a type of insurance that pays you for your damages when an at-fault motorist doesn’t have any insurance. It can also pay out under certain circumstances when you were injured by a hit-and-run or phantom driver. Underinsured motorist coverage, or “UIM,” is insurance that helps make up the difference when an at-fault motorist had insurance, but the policy limits were too low to compensate you for all of your damages. If a person has uninsured motorist coverage and is in an accident with an uninsured motorist, he or she can collect from his or her insurance company to recoup damages. Most underinsured motorist policies do not require the insurance company to pay if the insured person has settled with the other driver’s insurance company. This can be a very costly mistake. Therefore, it is important that you consult with a firm that is experienced in dealing with automobile accident cases before you settle any portion of your claim. Car accidents involving uninsured motorists can be extremely serious, and may result in hundreds of thousands of dollars in property damage, medical expenses and other costs. Unfortunately, many drivers’ own insurance companies attempt to undervalue their case, or will only pay a small portion of what an experienced uninsured motorist lawyer could recover for them. These expenses can be especially high if there were injuries or significant damages as a result of the accident.

Your uninsured motorist coverage insures you and the passengers in your vehicle who suffer bodily harm caused by a driver with no insurance. If another driver is using your car with your permission, he or she is also covered by your UM (uninsured motorist) coverage. Underinsured motorist (UIM) coverage is similar to uninsured motorist coverage. This type of insurance pays the difference between the other driver’s insurance limits and the total damages for bodily injury. For example, if the other driver’s insurance policy covers $20,000, and medical bills for your injuries are $40,000, your underinsured motorist coverage will pay the remaining $20,000, depending on your policy limits. UM and UIM coverage are often sold as one. If you have more than one car wih uninsured and underinsured coverage, you can also stack the coverages in Alabama.

How do I Know if I Have Uninsured Motorist Coverage?

Everyone who purchases auto insurance in Alabama must be offered uninsured motorist coverage. Unless you declined this coverage in writing, your policy most likely includes coverage for accidents involving uninsured and hit and run drivers. You also have purchased underinsured motorist coverage normally. A simple call to your agent and a review of your policy will show if you have the coverage.

Why Hire Uninsured/Underinsured Motorist Attorneys Ferguson and Ferguson

The law offices of Ferguson and Ferguson takes pride in handling your insurance cases.

- We are committed to excellent client service.

- We care about our clients, and have patience.

- Free phone consultation 7 a.m. to 7 p.m. and Saturdays

- Free office consultation as late as 7 p.m. and Saturdays also

- Locations in Decatur and Huntsville

- We come to you if you are injured

- We answer all our clients calls, or return them promptly.

- We keep our clients informed of the status of their case.

- We make sure that our clients understand each step of their case.

- We have great compassion for the physical, emotional, and financial problems that our clients suffered, and will do everything possible to get them through their difficult time.

Free Consultation

Without the assistance of a skilled Alabama attorney, the insurance companies often will underpay, delay, or wrongfully deny payment of benefits to their own policyholders. If you have been injured or your vehicle was damaged in a collision with an uninsured motorist, please contact the Decatur and Huntsville uninsured motorist law firm of Ferguson & Ferguson for a free initial consultation and case evaluation. You do not pay unless you recover. Call now. Call 256-534-3435 or 1-800-752-1998 today. We are here to help.

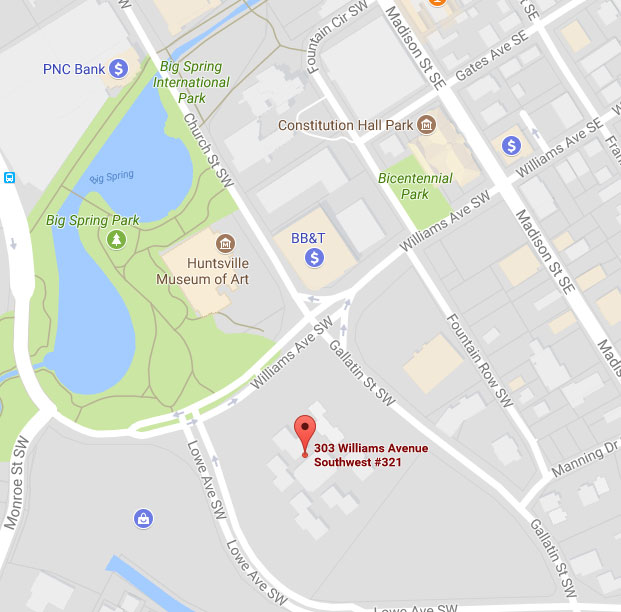

Huntsville Office Location:

303 Williams Avenue Southwest

Suite 321

Huntsville, AL 35801

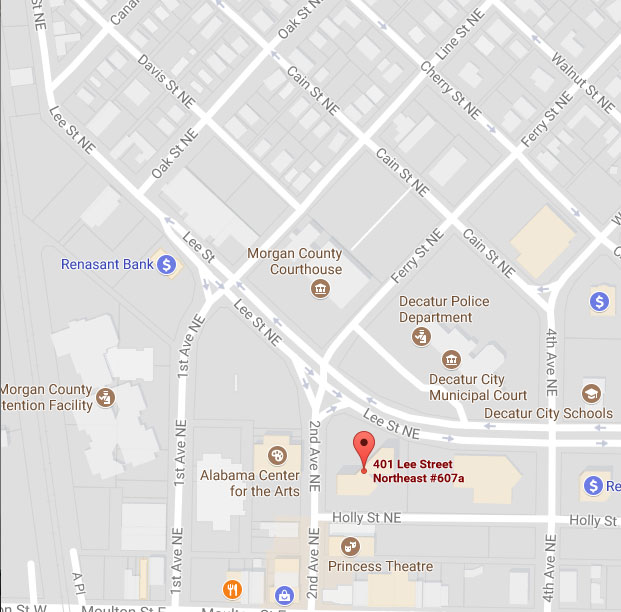

Decatur Office Location:

211 Oak Street Northeast

Decatur, AL 35601

Our automobile accident insurance attorneys serve every city and town in the State of Alabama.